Table Of Content

Just because a lender is willing to give you money for a home doesn’t necessarily mean that you have to jump into homeownership. It’s a big responsibility that ties up a large amount of money for years. Perhaps more importantly, however, you avoid putting yourself at the limits of your financial resources if you choose a house with a price lower than your maximum. But beyond that you’ve got to think about your lifestyle, such as how much money you have leftover for travel, retirement, other financial goals, etc. You might find that you don’t want to buy the most expensive home that fits in your budget.

Mortgage Tools

This suburb is also home to a variety of parks such as Walnut Creek Nature Park and Morgan Park which offer grassy areas perfect for a sunny picnic. Whether you’re currently buying a home in Southern California or looking to make the move to the West Coast, check out 10 of the best affordable suburbs within driving distance of Los Angeles. That way you don’t have to miss out on weekend visits to the Los Angeles County Museum of Art (LACMA) or watching a Los Angeles Lakers game at your favorite bar. Experts say you should understand what you can afford before you start looking for a house. Use this calculator to get an idea of how much you can borrow, and explore which ZIP Codes have a typical home price that will fit your budget.

Fun-Filled Things to Do in Palo Alto, CA if You’re New to the City

There are two House Affordability Calculators that can be used to estimate an affordable purchase amount for a house based on either household income-to-debt estimates or fixed monthly budgets. This loan is a great option for anyone who is a veteran or currently serving in the United States military. The loan does not require any down payment, and unlike other loans, it also does not require private mortgage insurance. Where you live plays a major role in what you can spend on a house. For example, you’d be able to buy a much bigger piece of property in St. Louis than you could for the same price in San Francisco.

Redfin Selling Options

Bay Area home buyers need $10,000 a month to afford a house - San Francisco Chronicle

Bay Area home buyers need $10,000 a month to afford a house.

Posted: Wed, 18 Oct 2023 07:00:00 GMT [source]

Longer terms usually have higher rates but lower monthly payments. It is possible to pay down your loan faster than the set term by making additional monthly payments toward your principal loan balance. Homeowner's insurance is based on the home price, and is expressed as an annual premium. The calculator divides that total by 12 months to adjust your monthly mortgage payment.

Lenders require that buyers obtain homeowners insurance in order for the insurance premium to be included in the monthly mortgage payment. Most home loans require a 20% down payment, but Federal Housing Administration (FHA) loans only require a minimum of 3.5%. This type of loan opens the door for many potential homeowners that do not have the savings for a substantial down payment.

From the Hollywood Sports Paintball & Airsoft Park to The Los Angeles County Fire Museum, you’ll be close to what makes Bellflower unique. Check out our guide to finding open houses in your area, plus tips on how to prepare for them. There are several steps in the house-shopping process, from getting initial mortgage approval to viewing a house in person. Read on to calculate how much house you can afford and learn what this means for whether you should buy a house. Along the same lines of thinking, you might consider holding off on buying the house.

The Average Income Needed To Afford A Home In The US Today Exceeds The Average Income By Tens Of Thousands ... - Yahoo Finance

The Average Income Needed To Afford A Home In The US Today Exceeds The Average Income By Tens Of Thousands ....

Posted: Mon, 04 Dec 2023 08:00:00 GMT [source]

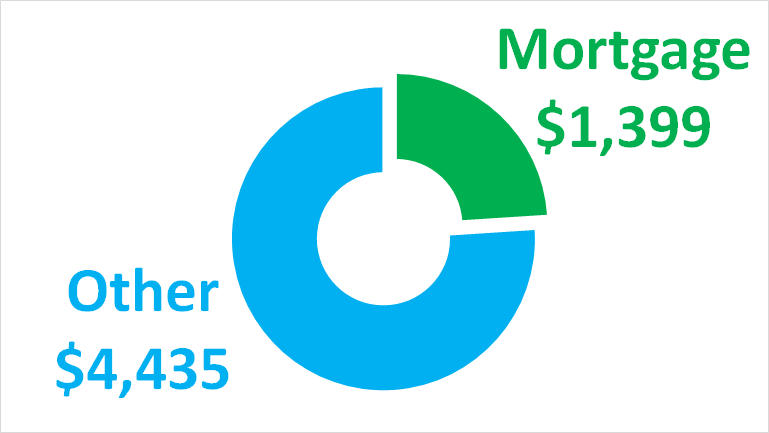

In order to determine how much mortgage you can afford to pay each month, start by looking at how much you earn each year before taxes. Then take your annual income and divide by 12 to determine your monthly income. For example, let’s say that you could technically afford to spend $4,000 each month on a mortgage payment. If you only have $500 remaining after covering your other expenses, you’re likely stretching yourself too thin. Remember that there are other major financial goals to consider, too, and you want to live within your means. Just because a lender offers you a preapproval for a large amount of money, that doesn’t mean you should spend that much for your home.

If you have a low credit score, it may make sense to look at FHA loans instead. Learn how much income you’ll need to buy a house and what lenders consider when reviewing applications. Evaluate your full financial situation, your ability to pay off a mortgage and where you need to save for other expenditures. Once you’ve done all that, it’s time to go after that perfect home. You’ll also want to pay attention to how much debt you have, the size of the home loan you want, the amount of money you need to put down, and more. These factors can all influence how much home you can reasonably afford.

How does the type of home loan impact affordability?

The higher your credit score, the more house you can afford for the same down payment. A higher credit score will get you a lower interest rate, and the lower your interest rate, the more you can afford to borrow. Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio. The mortgage calculator lets you click "Compare common loan types" to view a comparison of different loan terms. Click "Amortization" to see how the principal balance, principal paid (equity) and total interest paid change year by year.

Your estimated annual property tax is based on the home purchase price. The total is divided by 12 months and applied to each monthly mortgage payment. The Federal Housing Administration (FHA) is an agency of the U.S. government.

The NerdWallet Home Affordability Calculator takes that major advantage into account when computing your personalized affordability factors. To calculate how much house you can afford, we’ve made the assumption that with at least a 20% down payment, you might be best served with a conventional loan. However, if you are considering a smaller down payment, down to a minimum of 3.5%, you might apply for an FHA loan. Drive 20 minutes outside of Los Angeles and you’ll find yourself in the suburb of Montebello.

APR (%) is a number designed to help you evaluate the total cost of a mortgage. The APR is calculated according to federal requirements and is required by law to be stated in all home mortgage estimates. This allows you to better compare how much mortgage you can afford from different lenders and to see which is the right one for you.

No comments:

Post a Comment